FIX Simulator On-Prem

Advance your trading system's testing capabilities with our FIX Server Simulator

Key Features

Customizable Responses

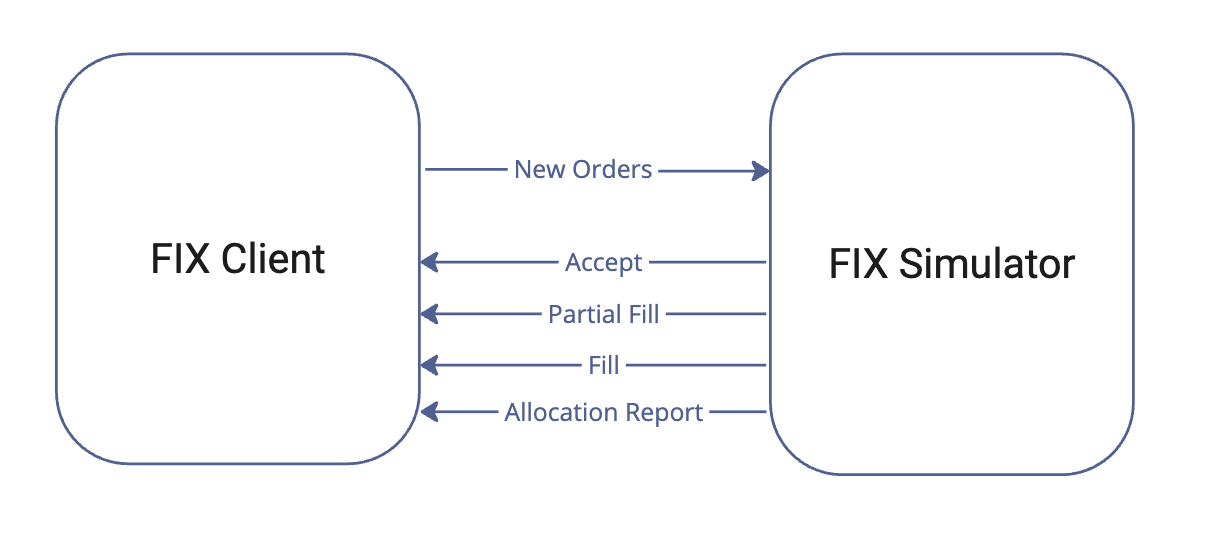

FIX Simulator can send accepts, rejects, fills and done for day messages depending on the order id pattern.

Extensive FIX Message Support

FIX Simulator supports both New Order Single and New Order Lists messages, as well as Execution Reports and Allocation Reports for complete order processing.

CI/CD Integration Testing

It is possible to integrate FIX Simulator into the CI/CD pipeline together with FIX Client to ensure the trades are executed as expected.

Scenarios

Developer Machine

In this scenario, developer runs both FIX Client and FIX Simulator on their own machine, allowing for a quick development and testing of the new features, e.g. in FIX Client.

To send the orders through FIX Client, a custom UI tool can be used or they can be inserted directly into the local database.

Integration Testing

In integration testing scenario, FIX Simulator is deployed to a dedicated testing machine, where it runs alongside FIX Client to process orders as they arrive.

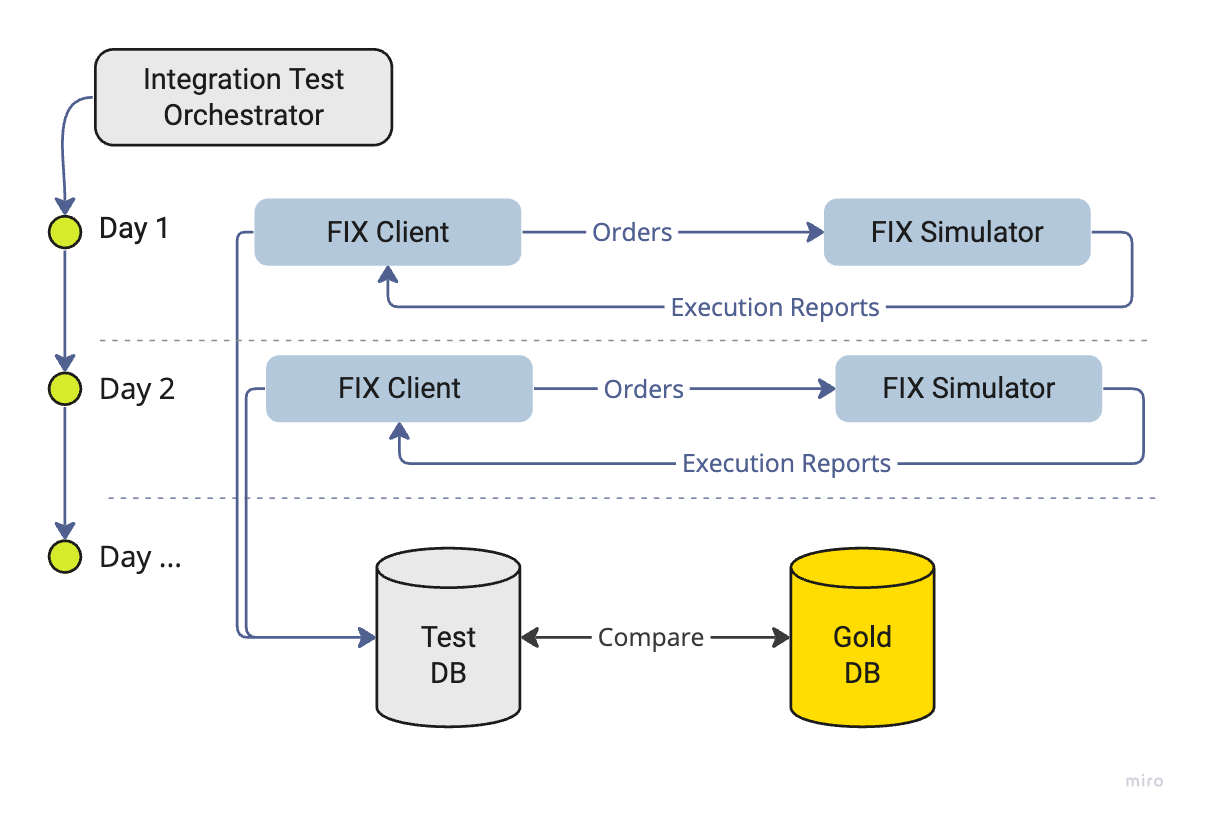

The testing is usually executed as follows (also see diagram below):

- A dedicated database is pre-filled with the necessary trading data for a given number of days. This data can contain either high-level information like the signal for each product on each day, or specific number of lots to place on that day.

- An orchestrator program takes care of running the whole integration testing procedure, spinning up FIX Client, FIX Simulator and other necessary programs in the right order.

- Orchestrator program has a loop over the number of days in the database, and on each day it reads the signal, generates orders, spins up FIX Client and FIX Simulator with a given date, and waits for them to execute the orders.

- In the end of the process, the newly generated database with executed orders is compared against a gold database to ensure there are no differences and the changes can be released to production.

Features

| Feature | Details |

|---|---|

| Order Types | NewOrderSingle NewOrderList |

| Order Entities | AllocationReport |

| Execution Report Types | ACCEPT CANCEL REJECT FILL PARTIAL_FILL DONE_FOR_DAY |

| Order Options | Can set specific execution time, FIX Simulator uses built-in storage to maintain state. |

| Instrument Pricing | Can connect to the instrument pricing database to find trade prices. |

| Other | Can specify custom datetime for CI/CD such that all reports will use it as a timestamp, otherwise real-time timestamp is used. |

Frequently Asked Questions

How easy is it to integrate FIX Simulator into our existing system?

Our FIX Simulator is built with ease of integration in mind, featuring minimal configuration and flexible options that can adapt to a variety of system architectures. Whether you have an established CI/CD pipeline or a standalone environment, our support team is available to assist with the initial setup and any customization requirements.

Can the FIX Simulator handle complex testing scenarios?

The simulator supports a wide array of FIX message types, including New Order Single, Execution Reports, and Order Lists. Additionally, it can simulate various order statuses such as partial fills and rejections, allowing for comprehensive end-to-end testing of trading workflows.

Is it possible to customize response scenarios beyond the default configurations?

Yes, you can configure custom responses for specific order types or scenarios, and define behaviors such as order acceptance, rejection, and delayed execution. If your use case requires additional customization, our team can work with you to implement custom logic tailored to your needs.

What level of logging and reporting does the FIX Simulator offer?

The simulator integrates with Serilog for advanced logging and provides detailed execution reports that can be used for auditing and debugging. You can also customize logging levels and formats to meet your compliance and monitoring requirements.

Get Started with FIX Simulator On-Prem

Enhance your testing processes and optimize your trading systems today.